What Are ICT Breaker Blocks?

Table of Contents

Toggle

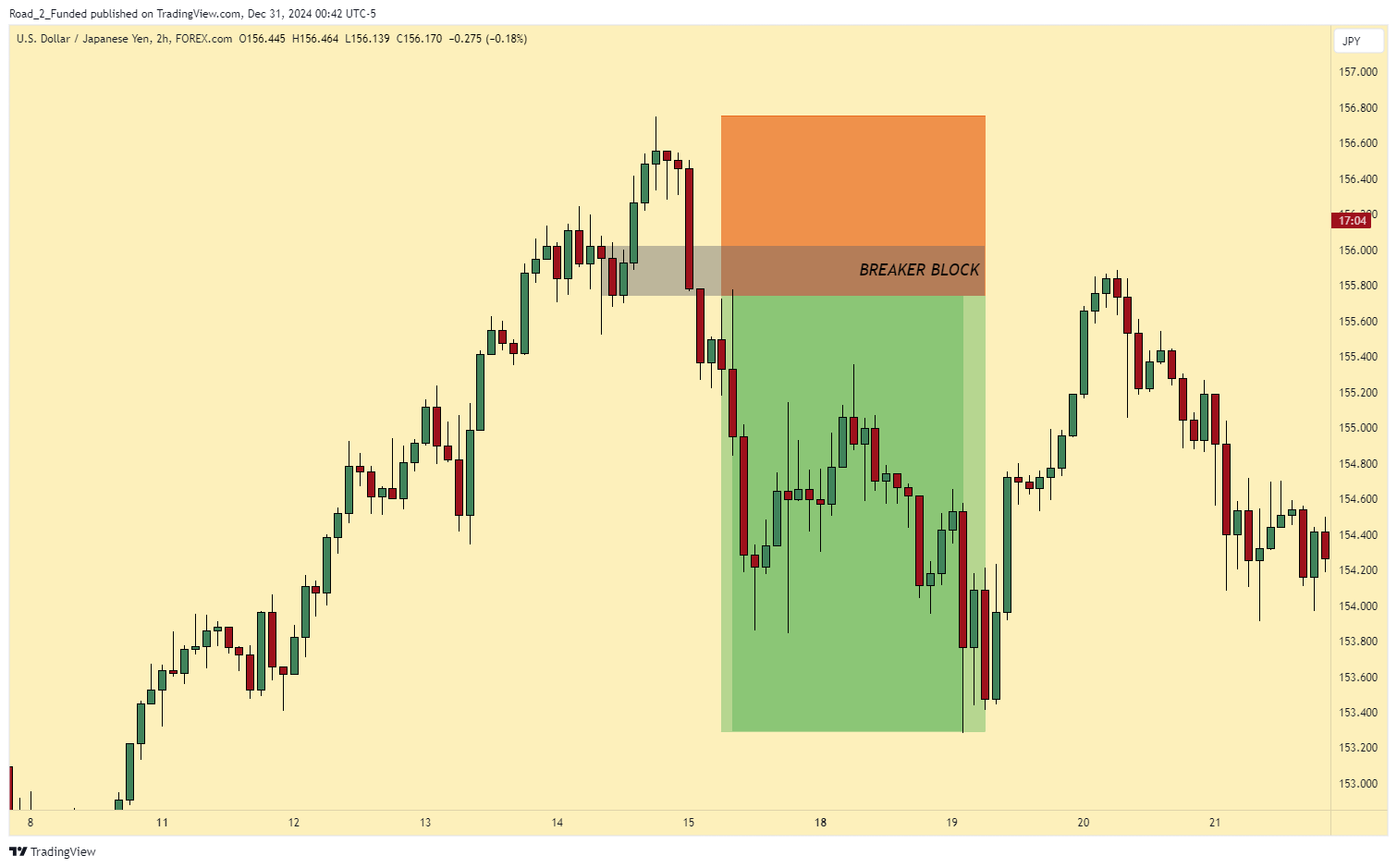

ICT Breaker Blocks are a concept from the Inner Circle Trader (ICT) methodology, which focuses on understanding how institutional traders operate in the financial markets. Breaker Blocks occur when a price level that initially served as support or resistance is violated, and the market reverses, using that level as a pivot for future movement.

In simpler terms, a Breaker Block represents a failed support or resistance zone that eventually becomes a key level for entries and exits in the market. This concept is powerful for spotting trend reversals and continuation setups.

How Do ICT Breaker Blocks Work?

Breaker Blocks work by showing areas where the market has trapped traders on the wrong side of a move. Typically, these blocks form in areas where a previous price swing has been broken, leading to a reversal.

For example:

- In a bullish scenario, a bearish move that initially acts as resistance gets broken and later serves as a support level.

- In a bearish scenario, a bullish move that initially acts as support gets broken and later serves as a resistance level.

This mechanism often aligns with institutional trading activity, which manipulates price to induce liquidity before reversing direction.

Steps to Identify ICT Breaker Blocks

To trade Breaker Blocks effectively, you need to know how to spot them on a chart. Follow these steps:

- Look for a Strong Swing High or Low

Identify significant price levels where the market has previously reacted strongly, such as a swing high (resistance) or a swing low (support). - Observe a Violation of the Swing Level

Wait for the price to break above the resistance (or below the support). This marks the beginning of a potential Breaker Block. - Watch for a Retest

After the break, the market often returns to the broken level, either to use it as support (in a bullish scenario) or resistance (in a bearish scenario). - Combine with Market Context

Use higher timeframes and other ICT concepts, such as Fair Value Gaps (FVGs) and Orderblocks, to confirm the validity of the Breaker Block.

How to Trade Using ICT Breaker Blocks

Once you’ve identified a potential Breaker Block, here’s how you can trade it:

- Enter on the Retest

Wait for the price to return to the Breaker Block. Enter your trade when the price touches the level, with confirmation from price action (e.g., candlestick patterns or momentum shifts). - Set Your Stop Loss

Place your stop loss just below the Breaker Block (for a bullish trade) or above it (for a bearish trade). This minimizes risk if the setup fails. - Identify a Target Level

Use nearby liquidity zones, such as previous swing highs/lows or Fair Value Gaps, to set your profit target. - Monitor the Market

Watch how the price reacts at the Breaker Block and manage your trade accordingly. If the price struggles to move away from the level, consider reducing your position size or exiting early.

Common Mistakes When Trading Breaker Blocks

Trading Breaker Blocks can be highly effective, but traders often make avoidable errors. Here’s what to watch out for:

- Ignoring Market Context

A Breaker Block is most effective when combined with other ICT concepts. Trading it in isolation may lead to false signals. - Entering Without Confirmation

Jumping into a trade without waiting for clear price action confirmation can result in unnecessary losses. - Misplacing Stop Losses

Placing stops too close to the Breaker Block increases the risk of being stopped out by market noise. - Forcing Trades

Not every broken swing level is a valid Breaker Block. Be selective and only trade setups that align with your overall strategy.

Final Thoughts on ICT Breaker Blocks

ICT Breaker Blocks are a powerful tool for understanding market dynamics and spotting high-probability setups. By learning to identify and trade these levels, you can align your strategy with institutional order flow and improve your trading consistency.

However, as with any trading concept, Breaker Blocks require practice and discipline to master. Take the time to backtest this strategy and combine it with other ICT concepts for the best results.

Private Coaching

If you’re ready to take your trading skills to the next level and learn how to apply Smart Money Concepts in real-time, book your free discovery session with me today! We’ll discuss your goals, assess your current trading strategy, and create a personalized plan to align you with the edge of trading like smart money.