Why Is Trading Hard? Unraveling the Complexities

Table of Contents

ToggleTrading is often portrayed as the ultimate pathway to financial freedom and wealth, yet for many, it remains one of the most challenging endeavors to master. From the psychological strain and market volatility to the technical intricacies and the ever-present risk of loss, trading can seem like an insurmountable challenge. In this comprehensive guide, we delve into the myriad reasons why trading is hard and explore strategies to overcome these hurdles. Whether you’re a beginner asking, “why is trading hard for me?” or an experienced trader looking to refine your approach, this post will shed light on the multifaceted challenges of trading and offer insights into how to navigate them successfully.

Introduction: The Reality of Trading

Trading is not for the faint of heart. Despite the myriad success stories and flashy headlines, the reality is that trading is hard. Every day, millions of traders face the daunting task of deciphering ever-changing market conditions, managing emotions, and making decisions under pressure. But why is trading so challenging?

In this article, we address the common question: why is trading hard? We explore the obstacles that many traders encounter—from the psychological burden to the technical complexities—and provide actionable insights on how to overcome these hurdles. By the end of this post, you’ll have a deeper understanding of the inherent difficulties of trading and be better equipped to approach the market with a balanced perspective.

Psychological Challenges in Trading

The Impact of Emotions

One of the most significant reasons why is trading hard stems from the psychological demands of the activity. Trading is an emotional rollercoaster that can trigger anxiety, excitement, fear, and even euphoria. These emotions, if not managed properly, can lead to impulsive decisions and poor risk management.

Key Emotional Challenges:

- Anxiety and Stress: Constant monitoring of positions and fear of market reversals can induce high levels of stress.

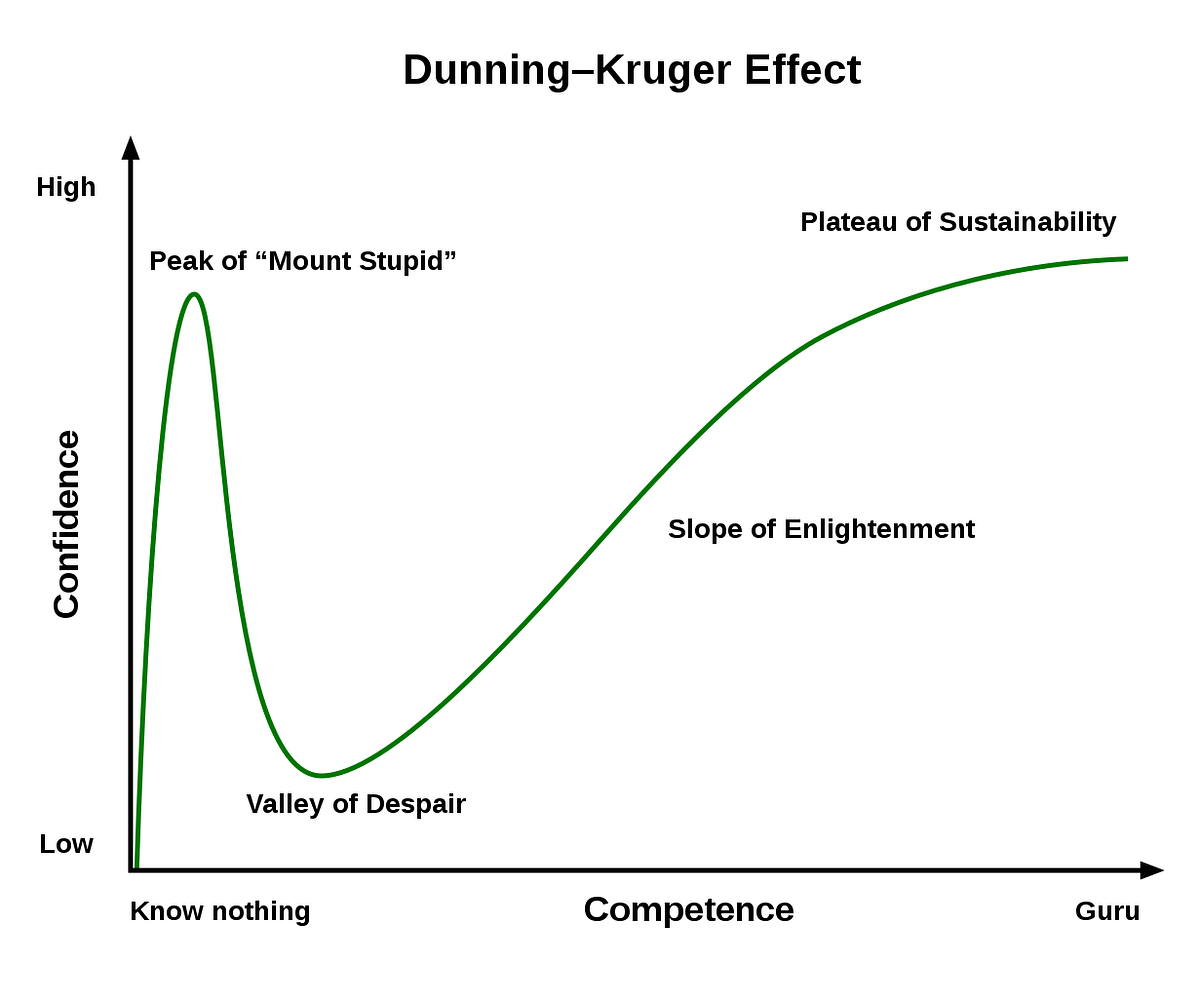

- Overconfidence: After a series of wins, traders may become overconfident, leading to risky decisions.

- Regret and Frustration: Losses can trigger regret, making it difficult to stick to a strategy or plan.

Emotions can distort perception and decision-making. Successful traders often highlight the importance of maintaining a level head and relying on well-tested strategies rather than succumbing to emotional impulses.

Cognitive Biases and Their Effects

Human cognition is riddled with biases that can significantly affect trading decisions. Recognizing these biases is crucial to understanding why is trading hard for many individuals.

Common Cognitive Biases:

- Confirmation Bias: The tendency to favor information that confirms preexisting beliefs.

- Anchoring: Relying too heavily on the first piece of information encountered (such as an initial price level).

- Loss Aversion: The fear of losses can be more painful than the joy of gains, leading to overly conservative trading.

These biases create blind spots in judgment, making it challenging to execute trades objectively. Awareness and deliberate countermeasures—such as journaling trades and engaging in regular self-assessment—can help mitigate these effects.

Fear of Loss and Greed

Fear and greed are two of the most powerful emotions in trading. The fear of loss often leads traders to exit positions prematurely, while greed can drive them to hold on to trades for too long, hoping for ever-greater profits.

- Fear of Loss: Can result in missed opportunities, as traders might avoid taking necessary risks.

- Greed: Might cause traders to overextend their positions, exposing them to significant losses when the market reverses.

Understanding that losses are an inherent part of trading—and that no strategy is foolproof—is essential for building resilience. A balanced mindset that accepts occasional losses as part of the trading journey is a cornerstone of long-term success.

Market Volatility and Uncertainty

Understanding Market Dynamics

Markets are inherently volatile, and this unpredictability is a key reason why is trading hard. Price movements are influenced by countless factors, from macroeconomic trends to investor sentiment, making it challenging to forecast with absolute certainty.

- Volatility: Sudden and unpredictable price movements can lead to rapid gains or losses.

- Uncertainty: The lack of a consistent pattern means that even the best analysis can sometimes lead to unexpected outcomes.

Traders need to develop robust strategies that account for volatility, often incorporating risk management techniques to mitigate the impact of sudden market moves.

Economic Events and Geopolitical Factors

Global events can dramatically affect market conditions in a matter of seconds. Economic reports, political instability, and geopolitical tensions all contribute to market uncertainty.

- Economic Reports: Data releases like GDP growth, employment figures, and inflation reports can cause significant market movements.

- Political Events: Elections, policy changes, and international conflicts often trigger abrupt shifts in market sentiment.

- Geopolitical Tensions: Issues such as trade wars or regional conflicts can lead to periods of extreme volatility.

Traders must remain vigilant and adapt quickly to external factors. Keeping abreast of current events and incorporating fundamental analysis into trading decisions is crucial for navigating these turbulent waters.

The Role of Liquidity and Volume

Market liquidity—the ease with which an asset can be bought or sold—plays a critical role in trading. Low liquidity can lead to larger price swings and make it difficult to execute orders at desired prices.

- High Liquidity: Typically leads to more stable price movements.

- Low Liquidity: Can result in slippage, where orders are filled at prices significantly different from expected levels.

Understanding liquidity dynamics is essential, especially when trading in less liquid markets or during off-peak hours. Traders must factor in volume and liquidity when planning their trades, as these elements can be pivotal in determining success or failure.

The Technical Complexities of Trading

Chart Analysis and Technical Indicators

One of the technical challenges in trading is mastering chart analysis and technical indicators. With countless tools and methodologies available, selecting and interpreting the right ones can be overwhelming.

- Chart Patterns: Traders use patterns such as head and shoulders, triangles, and flags to predict future price movements.

- Technical Indicators: Indicators like Moving Averages, RSI, MACD, and Bollinger Bands offer insights into market trends and momentum.

While these tools are powerful, they are not foolproof. The overabundance of indicators can lead to analysis paralysis—where too much information makes it hard to decide on a trade. Successful traders often simplify their approach, focusing on a few key indicators that align with their strategy.

Trading Platforms and Execution Challenges

The choice of a trading platform can significantly impact a trader’s efficiency and effectiveness. Issues related to technology and execution add another layer to the question of why is trading hard.

- Platform Reliability: Downtime or slow execution during critical moments can result in missed opportunities.

- User Interface Complexity: A complicated interface may distract from core analysis and decision-making.

- Order Execution: Slippage, latency, and order rejection are common technical issues that can adversely affect trades.

Selecting a robust trading platform with reliable execution, real-time data feeds, and user-friendly features is paramount for minimizing technical disruptions.

Algorithmic and High-Frequency Trading

The rise of algorithmic and high-frequency trading (HFT) has changed the market landscape dramatically. These systems can process and execute trades at speeds far beyond human capabilities, creating an uneven playing field for retail traders.

- Algorithmic Trading: Uses computer programs to execute trades based on predefined criteria. While these algorithms can be highly effective, they are also complex and require constant monitoring.

- High-Frequency Trading: HFT firms leverage advanced technology to capitalize on fleeting market opportunities, often leaving retail traders at a disadvantage.

The presence of these advanced trading systems means that individual traders must be even more diligent in refining their strategies and managing risk.

Risk Management: The Cornerstone of Trading

Position Sizing and Stop Losses

One of the primary reasons trading is hard is the difficulty in managing risk effectively. Proper risk management is essential to survive the inevitable losses that come with trading.

- Position Sizing: Determining the correct amount to invest in a single trade is critical. Overexposure can lead to catastrophic losses, while underexposure might not generate enough profit.

- Stop Losses: These are orders set to automatically exit a trade at a predetermined price, limiting potential losses. They serve as a safety net in volatile markets.

A disciplined approach to risk management, with strict adherence to position sizing and stop loss rules, is indispensable for long-term success.

Diversification and Hedging Strategies

Diversification—spreading investments across various assets—helps mitigate risk by reducing exposure to any single market movement. Additionally, hedging strategies can be employed to offset potential losses.

- Asset Diversification: Investing in different asset classes, such as stocks, bonds, commodities, or currencies, can reduce risk.

- Hedging: Using instruments like options or futures to protect against adverse price movements is another effective risk management strategy.

A diversified portfolio, combined with appropriate hedging techniques, can help traders navigate market volatility more effectively.

Developing a Trading Plan

A well-crafted trading plan is the backbone of successful trading. It outlines strategies, risk management rules, entry and exit criteria, and contingency plans for different market scenarios.

- Clear Objectives: Define what you aim to achieve with your trading—be it short-term gains or long-term wealth accumulation.

- Rules and Guidelines: Establish strict rules for trade execution, risk management, and even emotional control.

- Continuous Evaluation: Regularly review and update your trading plan based on market conditions and past performance.

A solid trading plan reduces impulsive decisions and provides a framework to follow, making the inherently challenging process of trading more manageable.

Why Consistency is So Elusive

The Role of Discipline and Routine

Consistency in trading is often the most challenging aspect for many traders. Discipline is the glue that holds a trading strategy together, yet maintaining it day in and day out is easier said than done.

- Routine Building: Establishing a consistent trading routine can help create a disciplined approach. This includes setting aside specific times for analysis, trade execution, and review.

- Emotional Discipline: Developing a calm and methodical mindset is critical, particularly when faced with losses or market fluctuations.

- Sticking to the Plan: Deviating from your trading plan in moments of stress or excitement is a common pitfall that undermines consistency.

Discipline, coupled with a strict adherence to a trading plan, is the key to achieving consistency in an environment as unpredictable as the financial markets.

Overtrading and Impulsive Decisions

Overtrading is one of the most common reasons why trading remains difficult. Driven by the fear of missing out (FOMO) or the desire to recoup losses quickly, traders often take on more trades than they can manage.

- Impulsive Trading: Making decisions based on emotions rather than sound analysis leads to poor trade outcomes.

- Market Noise: Reacting to every market fluctuation rather than filtering out noise can result in a clutter of trades with little strategic value.

Implementing strict trade limits and taking regular breaks from the screen can help curb the tendency to overtrade and improve overall performance.

Adapting to Changing Market Conditions

Markets are dynamic, and strategies that work well in one market condition might fail in another. The challenge of adapting to different phases—trending, range-bound, or volatile—adds to the complexity of trading.

- Flexibility: Successful traders are those who can adapt their strategies to suit current market conditions.

- Continuous Learning: Staying informed about market trends and new trading techniques is crucial to maintaining an edge.

- Resilience: The ability to bounce back from losses and continuously adjust your strategy is key to long-term success.

The Learning Curve and the Journey to Mastery

The Importance of Education and Continuous Learning

Trading is a journey of continuous learning. The steep learning curve is one of the major reasons many ask, why is trading hard? Because mastering the markets requires a relentless pursuit of knowledge.

- Educational Resources: Books, online courses, webinars, and mentorship programs provide valuable insights.

- Practical Experience: Nothing beats real-world trading experience, even if it comes with a few losses along the way.

- Staying Updated: Markets evolve constantly; staying current with new trends and techniques is essential for sustained success.

Mentorship and Community Support

For many traders, guidance from more experienced peers can make the learning process less daunting.

- Mentorship Programs: Learning from those who have already navigated the challenges of trading can provide invaluable insights.

- Trading Communities: Joining online forums, social media groups, or local trading clubs offers support and a platform to share experiences and strategies.

The communal aspect of trading helps build resilience and offers a sounding board for refining strategies.

Backtesting and Strategy Refinement

A critical component of the learning process is backtesting trading strategies using historical data. This process helps validate strategies before risking real capital.

- Data Analysis: Using historical market data to test strategies can identify strengths and weaknesses.

- Continuous Improvement: Refining and adjusting strategies based on backtesting results is a hallmark of successful traders.

- Learning from Mistakes: Every failed trade is an opportunity to learn and improve.

Technological Advancements and Trading Tools

Automation and Trading Bots

The advent of automation and trading bots has revolutionized the trading landscape. While these tools can increase efficiency, they also add another layer of complexity.

- Algorithmic Trading: Automating trading decisions based on pre-set criteria reduces the emotional aspect of trading.

- Speed and Efficiency: Bots can process vast amounts of data and execute trades at lightning speeds, but they require rigorous programming and oversight.

- Human Oversight: Even the best algorithms need monitoring to ensure they adapt to real-time market changes.

Understanding how to integrate technology into your trading strategy is essential in a modern, tech-driven market.

Analytics and Data-Driven Decisions

Data analytics has become a cornerstone of trading strategies. Leveraging big data and advanced analytics tools helps traders make more informed decisions.

- Market Analysis: Tools that analyze historical and real-time data provide insights into market trends and potential reversals.

- Risk Management: Data-driven strategies help refine risk management techniques and improve position sizing.

- Predictive Analytics: Emerging technologies offer predictive insights, although they are not foolproof and require human interpretation.

The Pros and Cons of Modern Trading Platforms

Modern trading platforms offer an array of features, from advanced charting tools to real-time news feeds, but they come with their own challenges.

- User Interface: A well-designed interface can enhance decision-making, while a cluttered one can lead to mistakes.

- Reliability: Technical glitches, lag, or downtime can disrupt your trading routine.

- Customization: The ability to customize your trading environment is crucial, but it often requires a steep learning curve.

Selecting a platform that aligns with your trading style and needs is a critical decision for any trader.

Embracing Failure: Lessons from Losing Trades

Learning from Mistakes

Every trader, regardless of experience, encounters losses. Embracing these failures is essential to understanding why is trading hard and how to ultimately overcome its challenges.

- Post-Trade Analysis: Reviewing losing trades to understand what went wrong is a vital learning tool.

- Documentation: Keeping a detailed trading journal helps identify recurring mistakes and areas for improvement.

- Constructive Criticism: Analyzing your performance objectively, rather than succumbing to self-blame, fosters growth.

Developing a Resilient Mindset

Resilience is perhaps the most critical trait for a trader. The emotional and psychological toll of repeated losses can be overwhelming if not managed correctly.

- Mindfulness and Meditation: Practices that enhance focus and emotional balance can be beneficial.

- Setting Realistic Expectations: Understanding that losses are part of the process helps build mental resilience.

- Support Networks: Leaning on mentors or trading communities can provide emotional support during challenging times.

Case Studies of Notable Trading Losses

Examining high-profile trading failures can provide valuable lessons. Whether it’s a large institutional loss or a retail trader’s story, these case studies highlight common pitfalls and the importance of risk management.

- Institutional Setbacks: Even professional trading firms have experienced significant losses, underscoring that no one is immune to market volatility.

- Retail Trading Woes: Personal stories of traders who have learned from their mistakes often serve as cautionary tales for newcomers.

Overcoming the Challenges: Strategies for Success

Building a Robust Trading Strategy

A well-defined trading strategy that addresses the question of “why is trading hard?” is key to success. This involves:

- Clear Objectives: Define what success looks like for you—whether it’s consistent profitability or capital preservation.

- Testing and Refinement: Continuously backtest and refine your strategy based on market feedback.

- Adaptability: Be prepared to adjust your approach as market conditions evolve.

Utilizing Technology and Analytics

Modern technology provides traders with an edge—if used correctly. Embrace tools and analytics that can enhance your decision-making process.

- Automated Alerts: Use trading platforms that offer real-time alerts based on your criteria.

- Data Visualization: Leverage advanced charting tools and dashboards to gain a clearer picture of market trends.

- Algorithmic Assistance: Consider incorporating automated systems that can execute trades based on pre-defined rules.

Cultivating Discipline and Emotional Control

Perhaps the most critical factor in trading success is discipline. This includes:

- Sticking to Your Plan: No matter how tempting it is to deviate, adherence to your trading plan is paramount.

- Regular Review: Constantly assess your performance, learn from your mistakes, and adjust your strategy.

- Emotional Regulation: Develop strategies to maintain emotional balance, whether through mindfulness practices or by taking regular breaks from trading.

Conclusion: Embracing the Hardships of Trading

So, why is trading hard? The answer lies in its inherent complexity. Trading is a multifaceted endeavor that challenges traders on emotional, technical, and strategic levels. The volatile markets, the ever-present psychological battles, the intricate technical analysis, and the need for precise risk management all contribute to the difficulty.

However, the challenges of trading also create opportunities. Each obstacle is a chance to learn, adapt, and refine your approach. By understanding the reasons behind the struggles—whether it’s the emotional toll, market uncertainty, or technical complexities—you can begin to develop strategies that mitigate these challenges and enhance your overall performance.

Success in trading comes not from avoiding failure, but from embracing it as a vital component of the learning process. With discipline, continuous education, and a resilient mindset, you can overcome the obstacles that make trading hard and build a path toward consistent profitability.

Remember, every trader’s journey is unique. Whether you’re asking, “why is trading hard for beginners?” or grappling with the complexities as an experienced trader, the key is to keep learning, stay disciplined, and continuously adapt. Over time, these challenges can transform from insurmountable barriers into stepping stones on the road to trading mastery.

Final Thoughts

Trading remains one of the most challenging pursuits, but it is also one of the most rewarding. The difficulties you face are shared by countless traders around the world, and the strategies outlined in this post offer a way to navigate this complex landscape. With a commitment to continuous learning, disciplined risk management, and a clear understanding of market dynamics, you can overcome the inherent challenges and thrive in the world of trading.

As you reflect on why is trading hard, consider this guide a starting point—a comprehensive roadmap that not only highlights the challenges but also offers practical strategies to surmount them. Embrace the journey, learn from every trade, and remember that every challenge is an opportunity for growth.

Happy trading, and may your path to success be built on resilience, continuous learning, and a balanced approach to the complex world of financial markets.

Private Coaching

If you’re ready to take your trading skills to the next level and really want to answer the question “why is trading so hard?”, book your free discovery session with me today! We’ll discuss your goals, assess your current trading strategy, and create a personalized plan to align you with the edge of trading like smart money.