Daily Bias: 5 Secret Tips for Winning Trades

Table of Contents

Toggle

Table of Contents

- What Is Daily Bias in ICT Concepts?

- Why Daily Bias Is Key to Trading Success

- 5 Secret Tips for Determining Your Daily Bias

- Common Mistakes When Establishing Daily Bias

- Conclusion: Mastering Daily Bias for Winning Trades

What Is Daily Bias in ICT Concepts?

In ICT (Inner Circle Trader) concepts, it refers to a trader’s directional outlook for the day. It’s a critical component of trading strategy that guides whether you’re looking for long, short, or neutral setups.

Daily bias is not guesswork. It’s rooted in identifying the market’s institutional flow, based on liquidity pools, market structure, and key time-based patterns.

By establishing a clear daily bias, you align with smart money rather than falling into common retail traps.

Why Daily Bias Is Key to Trading Success

Daily bias helps traders by:

- Improving Trade Accuracy: A clear directional bias narrows your focus, reducing confusion and overtrading.

- Aligning with Smart Money: It ensures you’re trading with the institutions rather than against them.

- Enhancing Risk Management: Knowing the likely direction of the market helps you place stop-losses and targets strategically.

- Providing Clarity: A well-established bias eliminates indecision, making your trading plan more actionable.

5 Secret Tips for Determining Your Daily Bias

1. Start with Higher Timeframe Analysis

Always begin by analyzing higher timeframes, such as the daily or weekly chart, to understand the broader trend. Look for:

- Market structure shifts: Identify whether the market is making higher highs or lower lows.

- Key levels: Note previous day’s highs and lows, weekly opens, and significant support or resistance zones.

Pro Tip:

If the market is trending upward on the higher timeframe, lean toward a bullish daily bias. Conversely, a downward trend suggests a bearish bias.

2. Identify Liquidity Pools

Liquidity pools are areas where clusters of stop-loss orders or pending orders are likely placed. These areas often act as magnets for price action, making them critical for determining your bias.

- Buy-side liquidity: Found above recent highs, signaling potential upward movement to capture stops.

- Sell-side liquidity: Found below recent lows, signaling downward movement to sweep stops.

Pro Tip:

When price targets a liquidity pool, expect a reversal or continuation, depending on smart money behavior.

3. Pay Attention to ICT Killzones

Killzones are specific time windows during major trading sessions where liquidity is highest. These include:

- London Open (2:00 AM – 5:00 AM EST)

- New York Open (8:00 AM – 11:00 AM EST)

During these times, institutional players are most active, creating opportunities for high-probability setups.

Pro Tip:

Watch for price action in these killzones to confirm your bias.

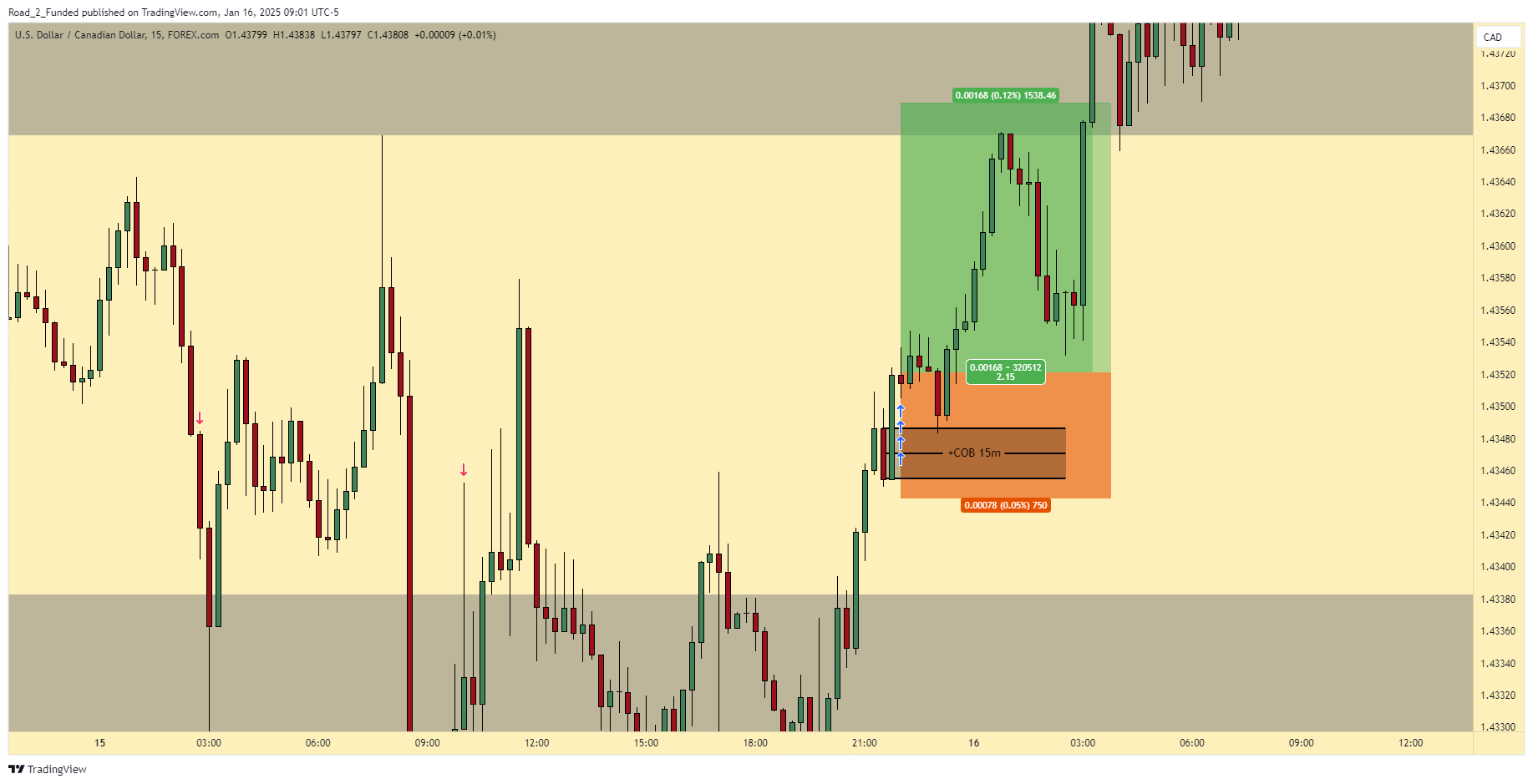

4. Watch for Breaks of Structure (BOS)

A Break of Structure (BOS) occurs when price breaks a significant support or resistance level, signaling a potential shift in market direction.

- Bullish BOS: Indicates potential upward movement.

- Bearish BOS: Suggests downward movement.

Pro Tip:

Combine BOS with liquidity grabs for a stronger bias confirmation.

5. Use Fair Value Gaps (FVGs) for Confirmation

A Fair Value Gap (FVG) represents an imbalance in price action. Price often retraces to these areas to rebalance before continuing its directional move.

Pro Tip:

Align your entries with FVGs that match your bias to increase trade accuracy.

Common Mistakes When Establishing Daily Bias

- Ignoring Higher Timeframes

Relying solely on lower timeframes can lead to false signals and confusion. - Overlooking Liquidity

Failing to identify liquidity pools may result in being on the wrong side of the market. - Not Waiting for Confirmation

Acting without observing BOS or FVGs often leads to premature entries. - Ignoring Killzones

Most high-probability setups occur during specific trading sessions. Missing these times reduces your chances of success. - Overcomplicating Analysis

Keep your bias simple by focusing on high-probability setups and avoiding unnecessary indicators.

Conclusion: Mastering Daily Bias for Winning Trades

Establishing a clear Daily Bias is essential for success in trading. By analyzing higher timeframes, identifying liquidity pools, observing killzones, and waiting for confirmation through BOS and FVGs, you can align with smart money flows and increase your chances of success.

Remember, trading is a game of probabilities. A strong daily bias gives you the confidence and clarity needed to execute your plan effectively. Practice these tips consistently, and watch your trading improve.

Private Coaching

If you’re ready to take your trading skills to the next level and really want to answer the question “is ICT worth it”, book your free discovery session with me today! We’ll discuss your goals, assess your current trading strategy, and create a personalized plan to align you with the edge of trading like smart money.