ICT PD Array Matrix: Unlocking The Best Trading Concept

Table of Contents

Toggle

What Is the ICT PD Array Matrix?

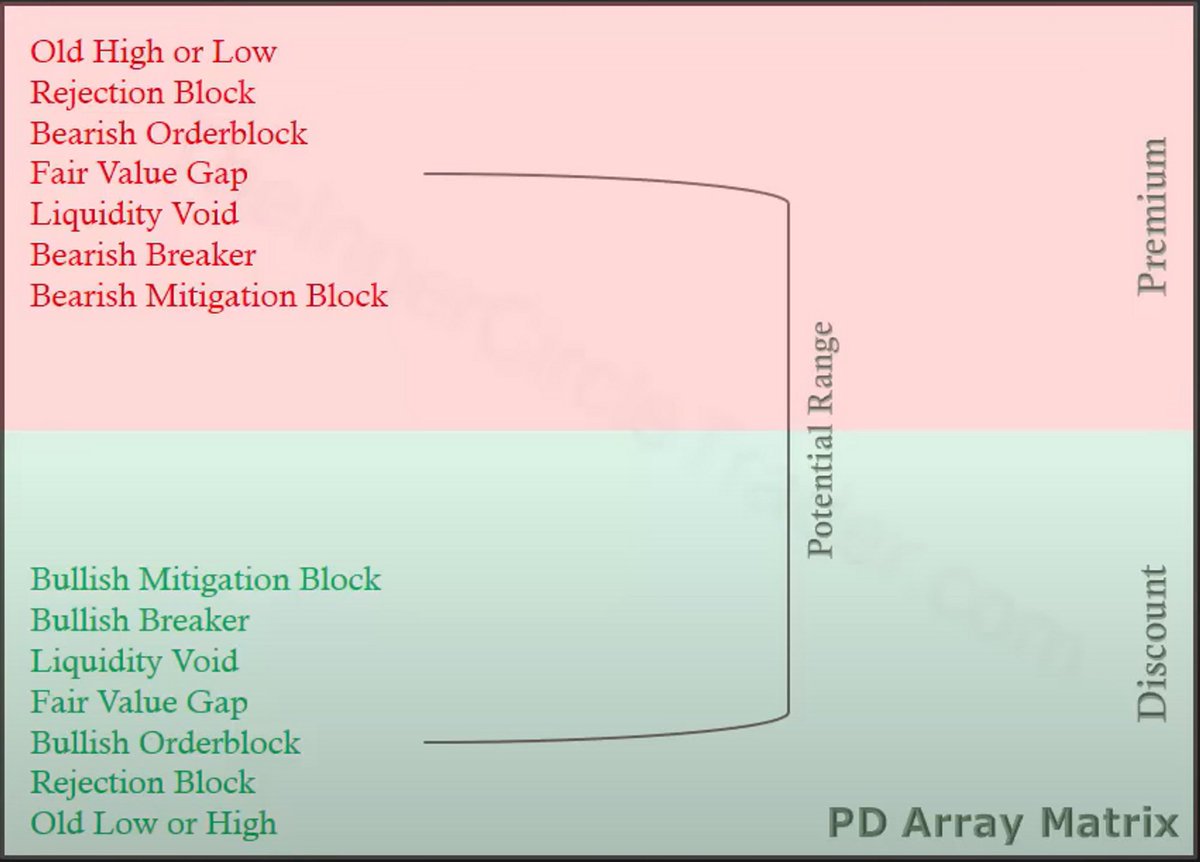

The ICT PD Array Matrix is a structured framework developed within the ICT (Inner Circle Trader) methodology. “PD” stands for Premium and Discount. At its core, it lays out how price moves from Discount Arrays to Premium Arrays (and vice versa), back and forth throughout different timeframes.

It helps traders identify and categorize where price is in this PD Array Matrix to better understand the flow of institutional trading. These arrays provide insight into market behaviors such as where price is likely to reverse, consolidate, or trend.

If you’ve ever felt lost trying to figure out why price moves the way it does, the PD Array Matrix offers a logical system to decode market movements. It’s a critical tool for traders aiming to align their strategies with Smart Money Concepts (SMC).

Check out this video I made on the topic, and how you can identify and use the ICT PD Array Matrix to your advantage.

How the PD Array Matrix Guides Institutional Trading

The PD Array Matrix is designed to reveal how institutional traders operate. It organizes price action into identifiable patterns, helping traders pinpoint optimal entry and exit points. By understanding how price engineers and raids liquidity across various levels, traders can anticipate where the market is likely to react.

For example, institutional traders often utilize order blocks, fair value gaps (FVGs), and mitigation zones to enter and exit trades. They may not use these names per say, but being able to classify and identify them on the chart allows us have a clear view of what is happening. The PD Array Matrix provides a way to map these areas and align your trades with institutional strategies.

Components of the ICT PD Array Matrix

The PD Array Matrix consists of several key elements that guide price action analysis:

- Order Blocks: Areas of consolidation where institutions enter trades, typically leading to significant price moves.

- Fair Value Gaps (FVGs)/Liquidity Voids: Imbalances in price action that often act as magnets for future price movement.

- Breaker/Mitigation Blocks: Price zones where the market is trapping traders in a trend continuation.

- Rejection Block: This price zone is can be identified by a large candle wick that may offer a reversal.

- Old High/Low: This is the final PD Array before price continues in a direction for a higher timeframe objective, or reverses for a Turtle Soup setup.

- Liquidity Pools: Zones of concentrated orders, such as stop-loss clusters, that smart money targets.

- Premium and Discount Levels: Price zones where the market is considered overvalued or undervalued, helping traders decide whether to buy or sell.

Each of these components serves as a building block for understanding market structure and institutional behavior.

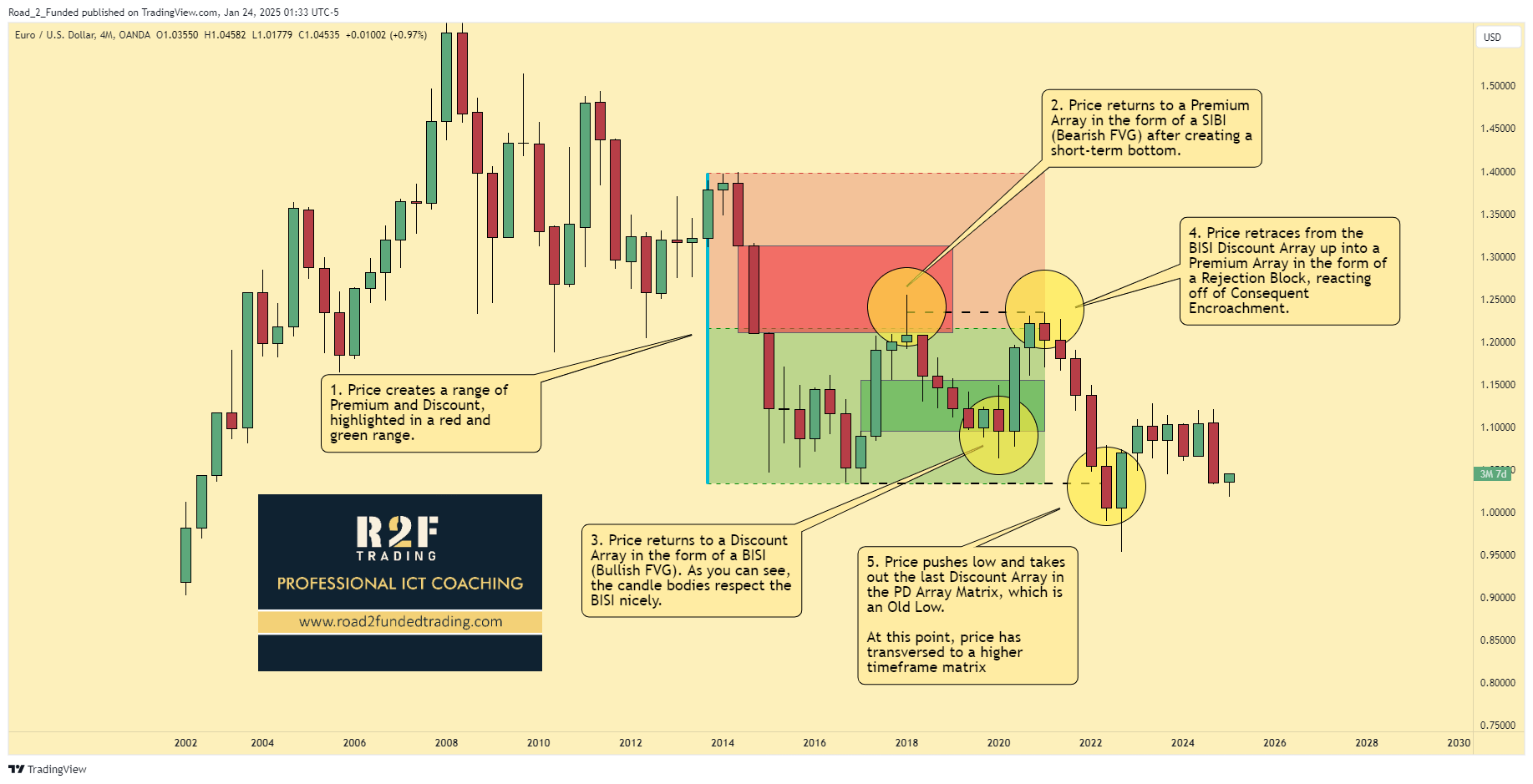

Below is a chart example with EUR/USD on the 4-month timeframe.

Using the PD Array Matrix in Your Trading Strategy

To incorporate the

into your trading:

- Identify Market Structure: Start by determining whether the market is in a bullish or bearish trend on a higher timeframe. Is it making higher highs or lower lows? Was there a shift in structure?

- Mark Key Levels: Highlight order blocks, liquidity pools, FVGs, and any clear PD Arrays on your chart. These are important to observe for sensitivity in price, or where price may be draw towards.

- Apply Premium and Discount Zones: Use Fibonacci retracements to identify areas where price may be likely to reverse/retrace. Equilibrium (50%) of the Fibonacci retracement tool is most applicable, but you can also include the OTE (Optimal Trade Entry) levels as well.

- Wait for Confirmations: Monitor price action for clear reactions at PD array levels before entering trades. That is one way to do it, but any entry model you have tested rigorously is fine. There is no one single way to trade.

- Focus on High-Probability Setups: Prioritize trades that align with the overall market structure and PD arrays. This will allow you get the highest-probability setups, especially if you include the aspect of Time Theory.

By following this systematic approach, you can make more informed trading decisions and reduce emotional reactions to fluctuations in price.

Benefits of Understanding the PD Array Matrix

- Improved Market Analysis: Gain a deeper understanding of price action and liquidity flows.

- Precise Entries and Exits: Identify high-probability trade setups with confidence.

- Alignment with Smart Money: Trade alongside institutional strategies instead of against them.

- Enhanced Risk Management: Use PD arrays to set realistic stop-loss and take-profit levels.

- Higher Win Rates: Leverage the predictability of institutional behaviors to improve your success.

The ICT PD Array Matrix is not just a tool; it’s a mindset shift that empowers traders to think like professionals.

Bear in mind, that price is fractal and this concept of Premium and Discount Arrays apply to all timeframes. What is key in this concept is understanding the ICT saying – “The bodies tell the story and the wicks do the damage”. Candle bodies are crucial in reading price, including the PD Array Matrix. Have a look at the video below for more insight into this concept.

Conclusion: Mastering the ICT PD Array Matrix

Mastering the ICT PD Array Matrix takes practice and dedication, but the rewards are worth it. Personally, it took me years before I fully got how it all tied together. Understanding how price is fractal and how the candle bodies “tell the story” were the largest factors for me. By understanding how institutional traders (or algorithms) operate and aligning your strategy with their methods, you can significantly improve your overall results.

If you’re ready to explore the ICT PD Array Matrix further, dive into resources like ICT tutorials, trading forums, and backtesting tools. With time and effort, you’ll unlock the full potential of this powerful framework.

Private Coaching

If you’re ready to explore the ICT PD Array Matrix further, dive into resources like ICT tutorials, trading forums, and backtesting tools. With time and effort, you’ll unlock the full potential of this powerful framework. Book your free discovery session with me today, and we’ll discuss your goals, assess your current trading knowledge and experience, and create a personalized plan to align you with the edge of trading like smart money.