Liquidity Trading: Mastering This Powerful Concept

Table of Contents

Toggle

What Is Liquidity Trading?

Liquidity trading refers to a trading approach that focuses on taking advantage of market liquidity—the availability of buyers and sellers in the market. High liquidity ensures smooth price action, tighter spreads, and minimal slippage. Low liquidity, however, can result in erratic price movements, wider spreads, and difficulty executing large trades without impacting the price.

In ICT (Inner Circle Trader) Concepts, liquidity is a key driver of price movements. Liquidity zones represent areas where orders are clustered, such as stop-losses and pending entries. These zones become targets for institutional players—referred to as smart money—to fill large orders and manipulate price movements to trap retail traders.

Understanding liquidity trading is essential for aligning your trades with the smart money flow and avoiding common retail traps.

Why Liquidity Trading Matters in ICT Concepts

In traditional trading, liquidity is often seen as a technical factor that impacts spreads and slippage. However, in ICT trading, liquidity is a primary market driver. Smart money targets liquidity pools to execute their large orders efficiently without causing unwanted price impact.

Here’s why liquidity trading matters:

- Liquidity pools act as magnets for price.

- Institutional traders need liquidity to execute large trades.

- Smart money creates false breakouts to capture liquidity.

By understanding how liquidity drives price action, traders can predict where the price is likely to go and position themselves accordingly.

Key Concepts of Liquidity Trading

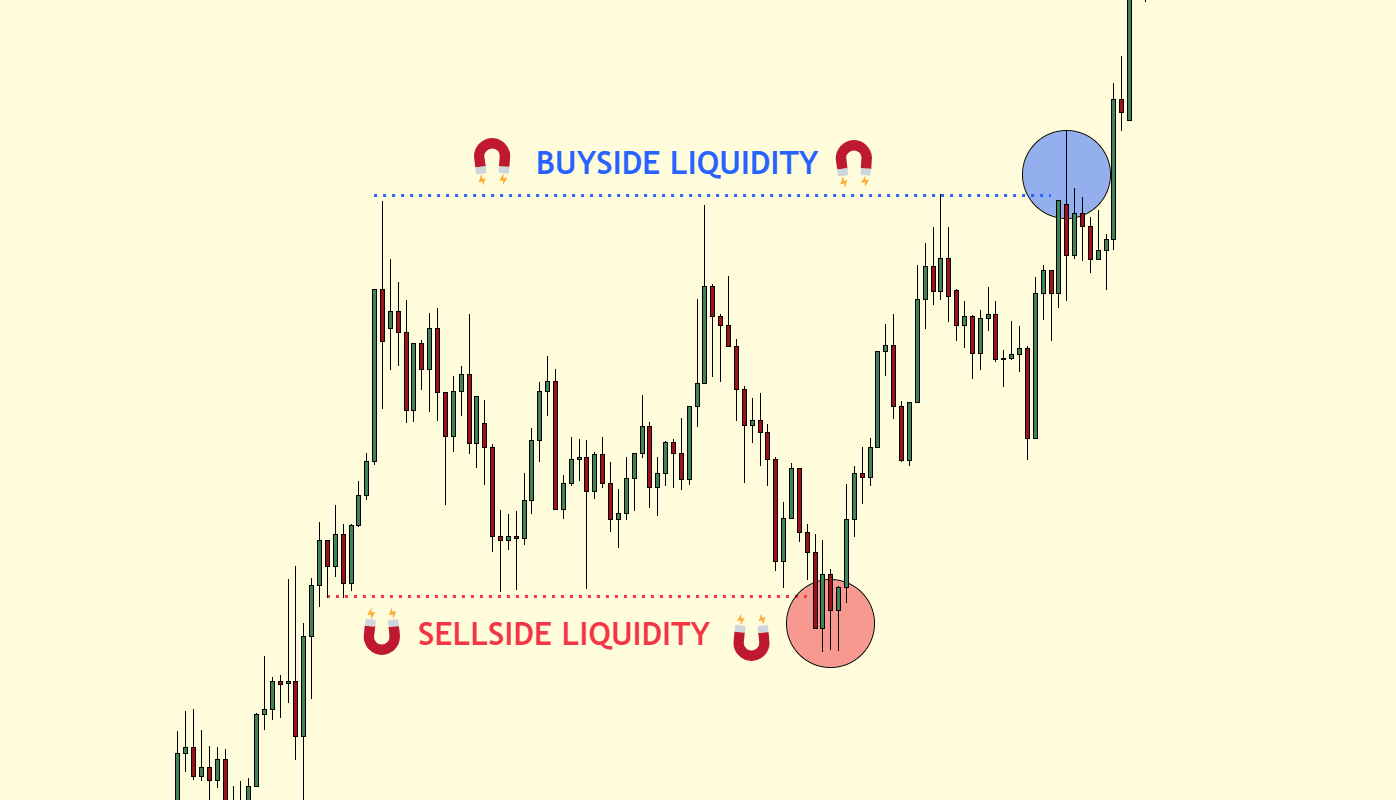

1. Liquidity Pools

Liquidity pools are areas where clusters of stop-loss or pending orders reside. These pools are typically found around recent highs and lows, key support and resistance levels, and round numbers.

For example:

- Buy-side liquidity exists above resistance levels, where traders place stop-loss orders for their short positions.

- Sell-side liquidity exists below support levels, where traders place stop-loss orders for their long positions.

Smart money targets these liquidity pools to trigger stop-losses and fill their large orders at optimal prices.

2. Equal Highs and Lows

Retail traders often identify equal highs and lows as strong support or resistance levels and place stop-loss orders around these areas. However, these levels become liquidity targets for smart money.

Example:

- If two swing highs are at the same level, retail traders assume it’s a strong resistance zone. Smart money pushes the price slightly above that level to trigger stop-loss orders before reversing the price.

Tip: Look for liquidity sweeps above equal highs or below equal lows as potential trade setups.

3. Buy and Sell Stops

Understanding buy stops and sell stops is essential for liquidity trading. These stops represent pending orders placed by traders to enter the market at certain price levels.

- Buy Stops: Placed above the current price to enter long positions when the price rises.

- Sell Stops: Placed below the current price to enter short positions when the price drops.

In ICT concepts, stop hunts occur when the market deliberately moves to trigger these stops, creating liquidity for large institutional orders.

How Liquidity Drives Market Movement

Sudden spikes or sharp declines in price are often the result of liquidity being taken. These moves aren’t random—they’re orchestrated by institutions to capture liquidity and rebalance their positions.

Here’s how liquidity drives market movement:

- Liquidity Grabs (Stop Hunts):

The market seeks out stop-loss clusters to capture liquidity before reversing direction. - False Breakouts:

Price breaks through a key level, triggering retail traders’ stops, only to reverse shortly after. - Reversal Points:

After liquidity is taken, the market often reverses at these key levels, providing high-probability trade setups.

By identifying these moves, traders can predict where the price is likely to go next and avoid getting caught in retail traps.

Practical Application of Liquidity Trading

To apply liquidity trading in your strategy, follow these steps:

- Identify Key Liquidity Levels:

- Look for recent highs and lows, order blocks, and round numbers.

- Watch for Liquidity Sweeps:

- Wait for the price to breach a liquidity pool and then reverse.

- Enter Trades After Liquidity Is Taken:

- Avoid entering trades during the liquidity grab. Instead, wait for the market to show signs of reversal.

- Use Risk Management:

- Place stop-loss orders beyond the liquidity pool to avoid being swept.

FAQs on Liquidity Trading

1. What Is a Liquidity Sweep?

A liquidity sweep occurs when the market temporarily breaches a key level to trigger stop-loss orders and then reverses in the opposite direction.

2. How Can I Identify Liquidity Zones?

Liquidity zones are areas where clusters of stop-loss orders are placed, usually around recent highs, lows, and round numbers.

3. Why Do Markets Target Liquidity?

Institutions need liquidity to execute large orders efficiently. By targeting liquidity pools, they can fill their positions without causing slippage.

4. What Are Buy and Sell Stops?

Buy stops are pending orders placed above the current price, while sell stops are placed below. These stops become liquidity targets for smart money.

Conclusion: Why Liquidity Trading Is a Game-Changer for ICT Traders

Understanding liquidity trading transforms how traders view the market. Instead of seeing price movements as random noise, you start recognizing patterns of institutional behavior.

By identifying liquidity zones, stop hunts, and false breakouts, you can align your trades with smart money and improve your trading accuracy. Incorporating ICT liquidity principles into your trading strategy will help you avoid retail traps and make more informed trading decisions.

Private Coaching

If you’re ready to take your trading skills to the next level and learn how to apply ICT concepts in real-time, book your free discovery session with me today! We’ll discuss your goals, create or assess your current trading system, and create a personalized plan for you to become a consistent and successful trader.