What Are Market Maker Models?

Table of Contents

Toggle

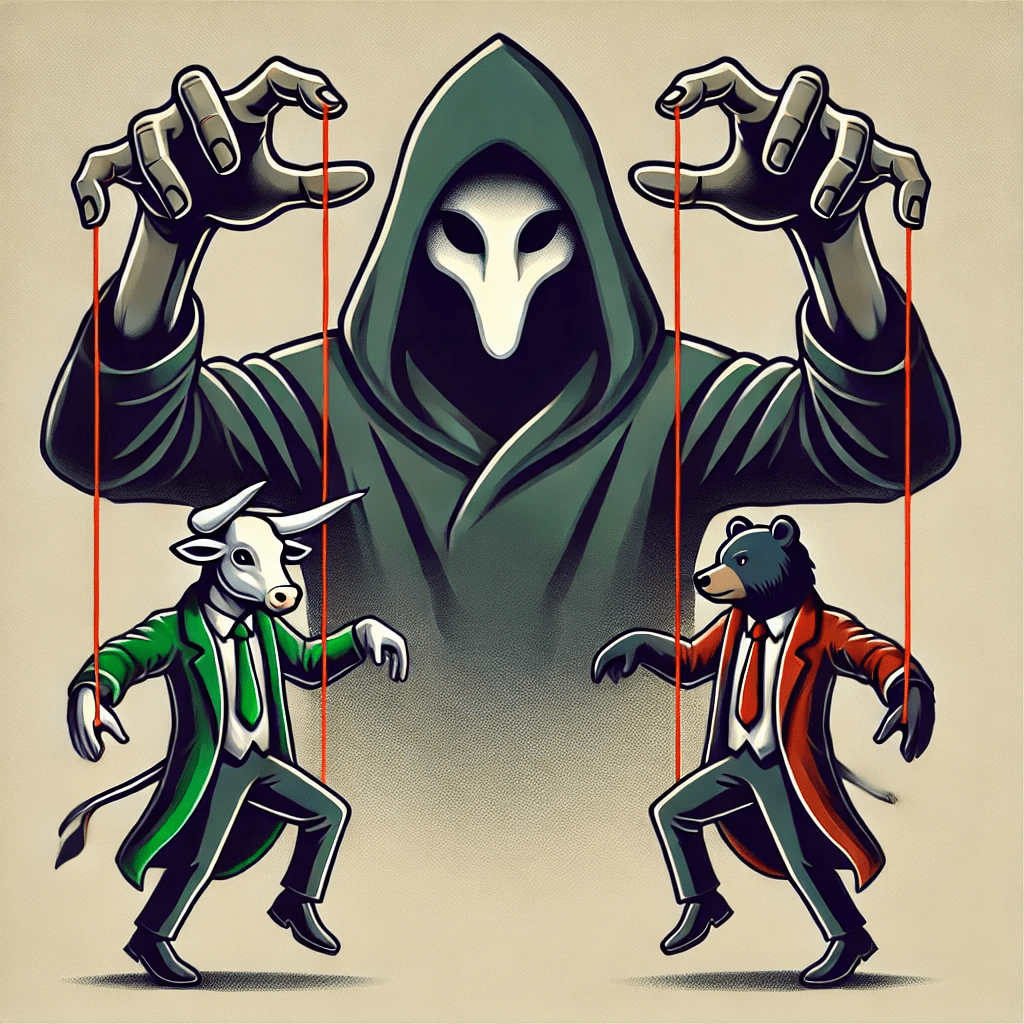

Market Maker Models (MMM) are a core concept in ICT (Inner Circle Trader) teachings, designed to help traders understand how institutional players—often referred to as market makers—manipulate price action to create liquidity and induce retail traders into making predictable mistakes.

These models reveal the patterns market makers use to grab liquidity, fill orders, and then reverse price direction, often catching unprepared traders off guard. ICT teaches traders to recognize these traps, giving them the tools to trade alongside institutional flow rather than against it.

Why Are Market Maker Models Important in ICT?

One of the biggest hurdles for retail traders is understanding why price moves the way it does. ICT’s Market Maker Models lift the curtain on the hidden strategies that drive price manipulation.

Market makers need liquidity to execute large orders, and they achieve this by enticing traders into predictable positions—creating setups like double tops, false breakouts, or trend continuations—only to reverse and target the liquidity sitting behind those levels.

For ICT traders, identifying these setups is a game-changer. You no longer trade blindly; instead, you anticipate market manipulation and align your entries with the “smart money.”

The Anatomy of a Market Maker Model

To fully grasp Market Maker Models, it helps to break them down into their core elements. Let’s look at how they typically play out:

- Liquidity Creation

Market makers build liquidity by enticing traders into one side of the market. For example, a rally might form a double top, luring traders to short the market. - Liquidity Grab

Once enough liquidity has built up (e.g., stop-loss orders above a double top), market makers push the price higher, triggering those stops. This creates the fuel for the next move. - Reversal and Expansion

After the liquidity grab, the market reverses direction and moves aggressively, often creating new highs or lows as it expands toward fresh liquidity zones. - Price Stabilization

Finally, the price stabilizes, and a new range or trend begins to form, setting the stage for the next cycle.

ICT traders learn to spot these stages in real time, enabling them to anticipate where price is likely to head next.

How to Identify Market Maker Models in Real Time

Spotting Market Maker Models requires a blend of technical skills and an understanding of market psychology. Here’s how to get started:

- Identify Key Liquidity Zones

Look for areas where traders are likely placing their stop-losses or limit orders, such as swing highs/lows, double tops, or Fair Value Gaps (FVGs). - Watch for Stop Hunts

A stop hunt is a telltale sign of market maker activity. When price sweeps above a resistance level or below a support level and then reverses sharply, it’s a strong indicator of a Market Maker Model. - Confirm the Shift in Market Structure

Once liquidity has been grabbed, look for a break in market structure. This signals that the market is shifting direction and aligns with the expansion phase of the model. - Use Higher Timeframes

Combine your analysis with higher timeframe charts to validate the setup. Market Maker Models are most reliable when they align with the broader trend or liquidity objectives.

Tips for Trading Market Maker Models

- Be Patient

The best Market Maker setups require patience. Wait for liquidity to build and the market to grab it before taking a position. - Combine ICT Tools

Use tools like Orderblocks, Fair Value Gaps, and Optimal Trade Entries to refine your entry points. These concepts work synergistic with Market Maker Models. - Trade with the Trend

While Market Maker Models can signal reversals, they’re most effective when they align with the overall trend or institutional liquidity objectives. - Manage Risk

Place your stop-loss below the liquidity grab (for longs) or above it (for shorts) to minimize risk if the setup fails.

Common Pitfalls to Avoid

- Chasing the Move

Don’t enter trades after the market has already expanded. The high-probability entry comes after the liquidity grab and before the expansion. - Ignoring Context

Market Maker Models don’t occur in isolation. Always consider the broader market context, such as higher timeframe trends and news events. - Over-complicating the Setup

Stick to the basics: liquidity grab, market structure shift, and confirmation. Over-analyzing can lead to missed opportunities.

Final Thoughts on Market Maker Models

Market Maker Models are an invaluable tool for traders looking to align themselves with institutional order flow. By understanding how liquidity is created, manipulated, and used to drive price, you can gain a significant edge in the market.

ICT’s teachings offer a roadmap for mastering these concepts, but the key lies in practice. Backtest Market Maker Models, combine them with other ICT concepts, and refine your strategy over time. With dedication, you’ll move from trading reactively to trading proactively—seeing the market through the eyes of the market makers themselves.

Private Coaching

If you’re ready to take your trading skills to the next level and learn how to apply Smart Money Concepts in real-time, book your free discovery session with me today! We’ll discuss your goals, assess your current trading strategy, and create a personalized plan to align you with the edge of trading like smart money.