Market Structure: The Foundations of Price Action

Table of Contents

Toggle

Table of Contents

- What Is Market Structure?

- Market Structure Definition in Trading

- Understanding Market Structure Shifts

- Market Structure Trading: A Strategic Approach

- Market Structure Examples for Traders

- How to Identify Market Structure on Charts

- Conclusion: The Power of Market Structure

What Is Market Structure?

It refers to the recurring patterns of price action that define the overall direction of a financial market. In trading, understanding market structure is essential for identifying trends, reversals, and consolidation phases.

It answers critical questions for traders, such as:

- Is the market trending or consolidating?

- Where is price likely to go next?

- What are the key levels to watch for entries and exits?

Mastering this is fundamental for aligning your trades with the underlying flow of the market.

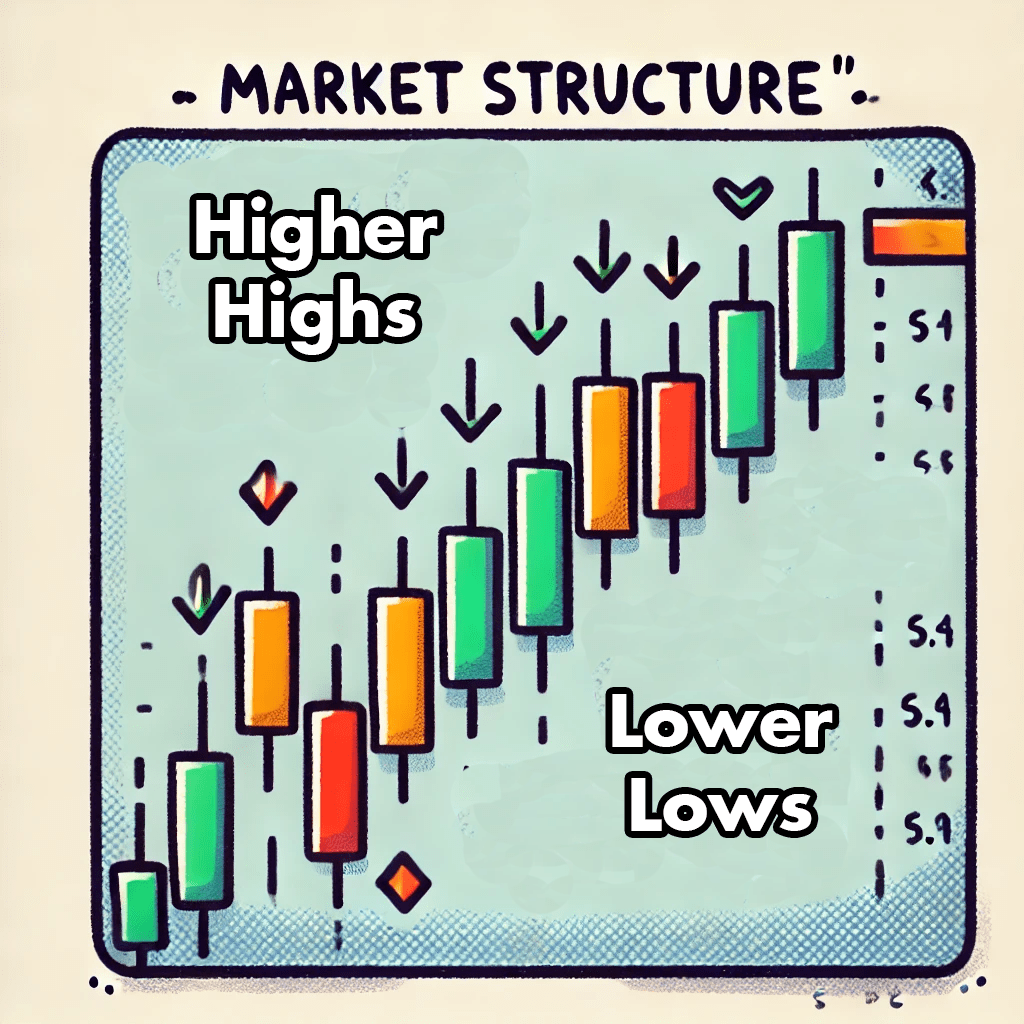

Market Structure Definition in Trading

The definition in trading involves identifying the arrangement of highs and lows on a price chart. Broadly, it can be categorized into three types:

- Uptrend: Higher highs (HH) and higher lows (HL).

- Downtrend: Lower highs (LH) and lower lows (LL).

- Range-Bound (Consolidation): Price oscillates within a defined range without a clear trend.

By understanding these formations, traders can determine the dominant trend and plan their trades accordingly.

Understanding Market Structure Shifts

A market structure shift (MSS) occurs when the market transitions from one trend to another, such as:

- Uptrend to downtrend: A significant lower high or lower low is formed, breaking the upward trend.

- Downtrend to uptrend: Price establishes a higher high or higher low, signaling a potential reversal.

Why Are Market Structure Shifts Important?

Market structure shifts are crucial because they:

- Indicate potential trend reversals.

- Reveal areas where institutional players may be entering or exiting the market.

- Provide traders with high-probability setups.

Market Structure Trading: A Strategic Approach

Market structure trading involves using the principles of market structure to guide your trading decisions. Here’s how:

1. Identify the Trend

Determine whether the market is in an uptrend, downtrend, or range. This will guide your directional bias.

2. Wait for a Shift

Monitor for market structure shifts, such as a break of significant highs or lows, to confirm a potential reversal or continuation.

3. Combine with ICT Concepts

Align your analysis with ICT tools, such as:

- Liquidity pools to identify key price targets.

- Order blocks and fair value gaps (FVGs) to refine your entries.

4. Use Higher Timeframes

Higher timeframes (e.g., daily, 4-hour) provide a clearer view of the overall market structure, while lower timeframes offer precision for entries.

Market Structure Examples for Traders

Let’s explore some examples to solidify your understanding:

Example 1: Uptrend with Retracements

- Price makes higher highs (HH) and higher lows (HL).

- Traders look for buying opportunities on pullbacks to key support levels or order blocks.

Example 2: Downtrend with Continuation

- Price forms lower highs (LH) and lower lows (LL).

- Traders anticipate sell opportunities at resistance levels or liquidity pools above swing highs.

Example 3: Range-Bound Market

- Price oscillates between support and resistance without establishing a trend.

- Traders look for breakout setups or trade within the range using defined levels.

How to Identify Market Structure on Charts

To identify market structure effectively:

- Mark Swing Highs and Lows

Identify the most recent swing highs and lows to determine the trend. - Look for Breaks of Structure (BOS)

A break of structure occurs when price moves beyond a significant high or low, signaling a potential trend shift. - Focus on Key Levels

Use tools like Fibonacci retracements, order blocks, and previous day’s highs/lows to pinpoint areas of interest. - Use Timeframes Strategically

Combine higher timeframe analysis for bias with lower timeframe precision for entries.

Conclusion: The Power of Market Structure

Market structure is the backbone of technical analysis and the foundation of many successful trading strategies. By understanding concepts like market structure shifts, recognizing key trends, and applying market structure trading techniques, you can gain an edge in the markets.

Practice identifying this on your charts, and combine this knowledge with tools like liquidity pools, order blocks, and ICT methodologies for maximum effectiveness.

With discipline and consistency, mastering market structure can transform your trading.

Private Coaching

Concepts like that are not difficult to learn, but sometimes some guidance can save you a lot of time and money. Get in touch and book your free discovery session with me today! We’ll discuss your goals, assess your current trading strategy, and create a personalized plan to align you with the edge of trading like smart money.