Optimal Trade Entry (OTE): A Fibonacci-Based Precision Tool in ICT Concepts

Table of Contents

Toggle

Table of Contents

- What Is Optimal Trade Entry (OTE)?

- The Role of Fibonacci Retracement in OTE

- Why OTE Is Crucial for ICT Traders

- How to Identify OTE on a Chart

- Steps to Trade Using OTE

- Common Mistakes When Trading OTE

- Conclusion: Mastering OTE in ICT Concepts

What Is Optimal Trade Entry (OTE)?

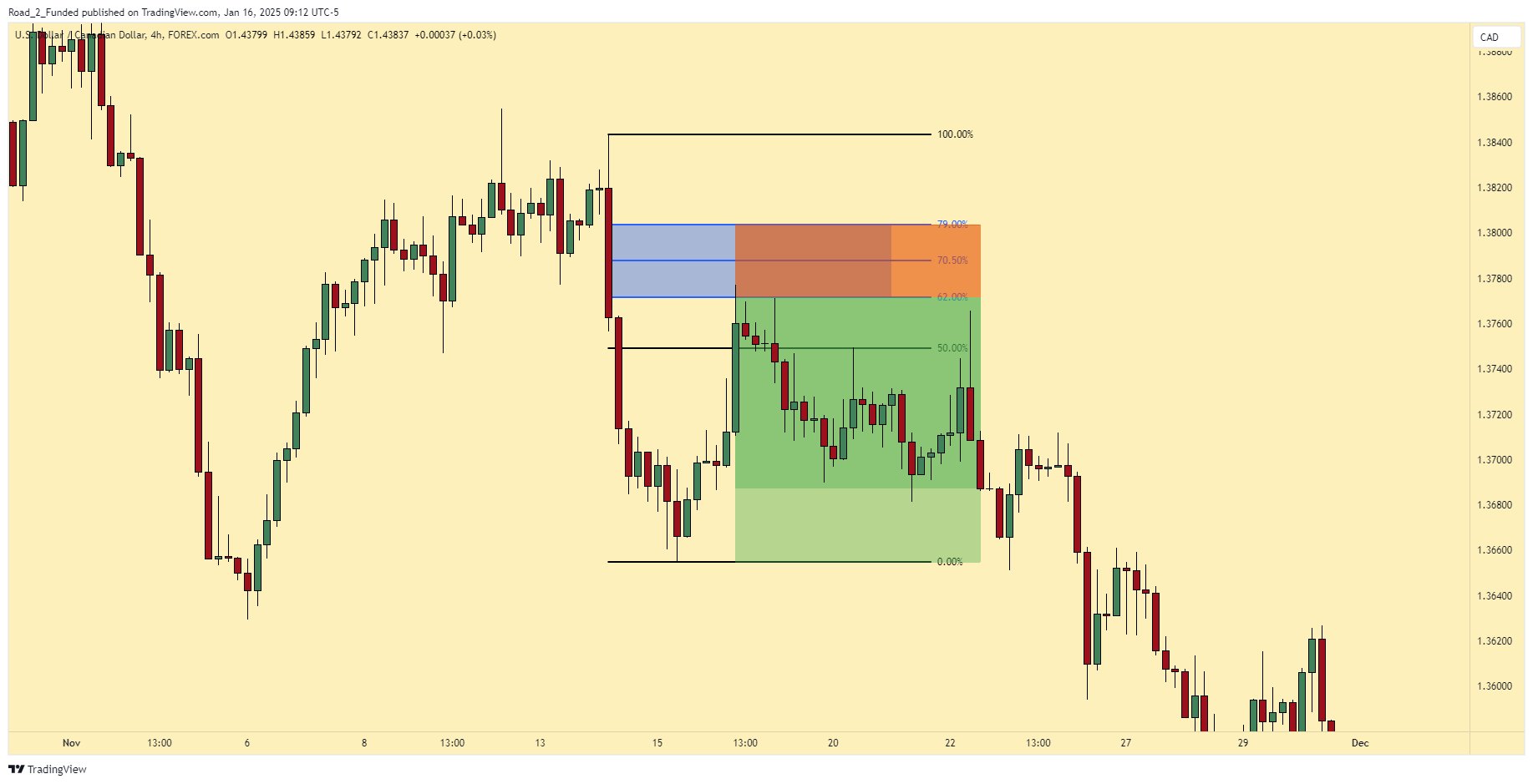

Optimal Trade Entry (OTE) is a precise trade entry method in ICT (Inner Circle Trader) Concepts that focuses on entering trades during specific retracement levels. Optimal Trade Entry leverages the Fibonacci retracement tool, specifically targeting the:

- 62%

- 70.5%

- 79%

These levels represent the optimal zone where price is most likely to reverse, offering traders an opportunity to align with smart money movements while minimizing risk.

Optimal Trade Entry is designed to provide high-probability entries by focusing on retracements that occur after a significant market move, ensuring that traders participate in the next leg of the trend.

The Role of Fibonacci Retracement in OTE

The Fibonacci retracement tool is fundamental to OTE. Here’s how it works:

- Identify the Swing Move:

Draw the Fibonacci retracement from the swing high to swing low (for bullish setups) or swing low to swing high (for bearish setups). - Focus on the OTE Zone:

The OTE zone lies between the 62%, 70.5%, and 79% retracement levels. This range reflects where price is most likely to react due to institutional activity. - Combine with ICT Concepts:

OTE is most effective when aligned with market structure, liquidity pools, and killzones for time-based confirmation.

Why OTE Is Crucial for ICT Traders

Understanding Optimal Trade Entry is advantageous for traders who want to:

- Maximize Risk-to-Reward Ratios:

Entering trades within the OTE zone allows for tighter stop-loss placement and larger profit potential. - Align with Smart Money Moves:

Institutions often operate around these Fibonacci levels, making OTE a reliable way to follow their footprints. - Improve Timing:

OTE provides a structured approach to entering trades, reducing emotional and impulsive decisions. - Avoid Retail Traps:

By focusing on retracements into the OTE zone, traders can avoid false breakouts and choppy market conditions.

How to Identify OTE on a Chart

1. Bullish Optimal Trade Entry

A bullish OTE occurs in a rising market after a pullback. Here’s how to identify it:

- Step 1: Identify a significant swing low and swing high.

- Step 2: Use the Fibonacci retracement tool, drawing it from the swing low to the swing high.

- Step 3: Look for price to retrace into the OTE zone (62%, 70.5%, 79%).

- Step 4: Confirm the entry with additional ICT tools, such as a liquidity sweep or a reaction at a fair value gap (FVG).

2. Bearish Optimal Trade Entry

A bearish OTE occurs in a falling market after a retracement. Here’s how to identify it:

- Step 1: Identify a significant swing high and swing low.

- Step 2: Apply the Fibonacci retracement tool from the swing high to the swing low.

- Step 3: Wait for price to retrace into the OTE zone (62%, 70.5%, 79%).

- Step 4: Confirm the entry using tools like order blocks or break of structure (BOS).

Steps to Trade Using OTE

Step 1: Analyze Market Structure

- Determine the trend on higher timeframes (e.g., 4-hour or daily).

- Look for breaks of structure to confirm the directional bias.

Step 2: Identify the Swing Move

- Locate the swing high and swing low that define the current market leg.

- Draw the Fibonacci retracement tool over this move.

Step 3: Mark the OTE Zone

- Highlight the range between the 62%, 70.5%, and 79% retracement levels.

- Look for confluence with liquidity pools, fair value gaps, or order blocks.

Step 4: Wait for Confirmation

- Monitor price action as it enters the OTE zone.

- Look for additional confirmation, such as a candlestick pattern or a reaction at a key level.

Step 5: Place Your Trade

- Enter your trade at the 70.5% retracement level, as it often represents the sweet spot within the OTE zone.

- Set a stop-loss just beyond the 79% level or below the liquidity pool.

- Define your take-profit target at the next key resistance or support level.

Common Mistakes When Trading OTE

- Misidentifying the Swing Move

OTE relies on correctly identifying the swing high and low. Failing to do so can result in inaccurate entries. - Ignoring Market Structure

OTE is most effective when aligned with the overall market trend. Avoid using it in choppy or range-bound markets. - Entering Without Confirmation

Always wait for additional confirmation, such as a reaction at a fair value gap or a liquidity sweep. - Overusing OTE on Lower Timeframes

OTE is more reliable on higher timeframes (e.g., 1-hour, 4-hour) where price action is less noisy. - Poor Risk Management

Ensure proper stop-loss placement and calculate your risk-to-reward ratio before entering any trade.

Conclusion: Mastering OTE in ICT Concepts

Optimal Trade Entry (OTE) is a cornerstone of ICT trading, providing traders with a reliable method for timing entries with precision. By focusing on the 62%, 70.5%, and 79% retracement levels, traders can align with smart money flows, avoid common pitfalls, and maximize their trading potential.

Remember, mastering OTE requires practice, patience, and consistent application of ICT principles like market structure, liquidity, and confirmation. With these tools, you can confidently identify and execute high-probability trades.

Private Coaching

If you’re ready to take your trading skills to the next level and learn how to apply the Optimal Trade Entry and other ICT concepts in real-time, book your free discovery session with me today! We’ll discuss your goals, create or assess your current trading system, and develop a personalized plan for you to become a consistent and successful trader.