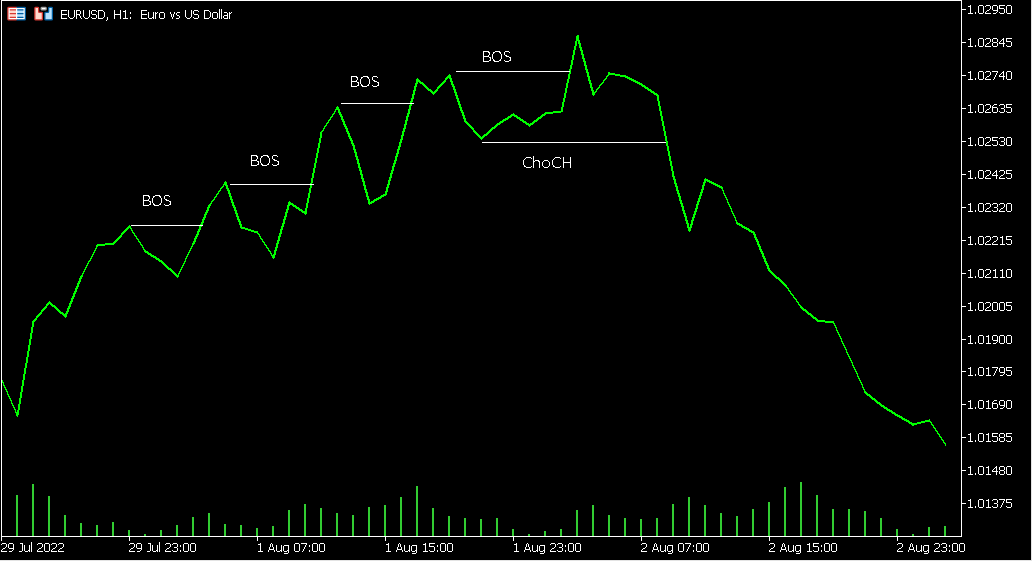

Smart Money Concepts

Table of Contents

ToggleIt was good when people used financial literacy as a luxury, but today, it has become a mandatory need in the fast-moving world. This involves comprehending how money operates, handling it effectively, and appreciating excellent investment opportunities, which tends to predict a prosperous financial stimulus. The two primary strategies to advance your financial growth quickly are to understand Smart Money Concepts moves and counsel from industry experts.

Financial Education

Successful financial management is one of those skills that people do not learn at school, and many of them feel uncertain about it. Decision-making knowledge can enable one to manage one’s finances, take charge of one’s life, minimize stress, and create wealth. From a financial point of view, smart money concepts outline the framework essential for the right decision-making regarding any money spent.

Choosing an Economic Expert Mentor

Experience as a form of learning is helpful; however, self-learning is quite different from gaining expert mentorship. An experienced supervisor is a rich source of knowledge and skills that cannot be found in any manual or online course. Here are several reasons why trading mentorship is a game-changer for financial success:

-

Budgeting and Saving

Tracking your income and expenditures is basic knowledge for handling money efficiently. Sacrificing some other expenses and developing a realistic budget will tell you whether you are overspending or developing a plan to save money in the future. They will also assist you in properly managing your savings so that you get the most out of them.

-

Investing Wisely

Saving is one of the best means of creating wealth, but few things may be more demanding to a novice than investing. You will learn how to invest skills from successful experts in any form of securities, including stocks, bonds, and even real estate. They will assist in explaining issues related to risk tolerance, diversification, and long-term versus short-term goals.

-

Understanding Debt

Not all forms of Debt are the same, and your mentor will explain the difference between the ‘good’ or necessary kinds of Debt, like a mortgage or student loans) and the ‘bad’ (like credit card debt). Smart Money Concepts an individual needs to know when, why, how, and when to manage, minimize, or avoid taking on Debt as much as possible to increase savings and invest.

-

Power of Compound Interest

Nothing is as vital in finance as understanding compounding or what is famously referred to as the world’s eighth wonder. If you begin making your investments or saving money at an early age, your money will compound at a very fast pace. Only an experienced teacher can explain how this principle should be used for constant success.

-

Property Conservation and Estate Management

When a person attains a level where they are accumulating large amounts of wealth, they must have a proper strategy of passing it on to the next generation. It includes knowledge of taxation matters, wealth management, and how your wealth is protected. The Best Trading Coach in the UK can guide you through these complex approaches, ensuring you achieve the most for your money with expert mentorship and strategies tailored to your financial goals.

-

Tailored Advice

Everyone has their financial status, so general guidelines do not usually apply. Consultation with an expert can enable them to devise a plan of action and guide you in the right financial direction depending on your financial goals Smart Money Concepts, including paying off an existing balance, starting to save, or investing in an existing and growing portfolio.

-

Team Accountability and Motivation

Instructors do not only educate but also ensure you meet the expected standards. It is especially possible that if many people are greedy and want to earn serious money, it can be easy to procrastinate or lose focus. It is far easier to keep one’s goals in mind and maintain focus when there is someone experienced to talk to about the tasks of Smart Money Concepts.

-

Learning from Experience

This is a major advantage because mentors can tell success and failure stories, as they have personally done. They can discuss things that have helped them, things that have not helped them, and things that have helped them financially. This insight alone is useful in preventing you from failing and spurring your growth.

How to Go About Selecting a Good Role Model

Choosing the right mentor can greatly influence you; however, depending on your financial objectives, beliefs, and preferred mode of study, you must select the correct teacher. To find a mentor, one should turn to a person who has always had good financial results, particularly in areas such as ICT Trading Concepts, to give you valid, implementable advice. Building trust is crucial as you need to feel comfortable discussing your financial goals and concerns—as it is vital to the success of the mentor/mentee relationship.

Conclusion

Smart Money Concepts investing concepts alone are not enough to achieve success in the financial arena. It needs practical support and follow-up, which are available from professional tutors. In its essence, you are committing time to learn while gaining the guidance of someone who has already actively engaged in the financial territory, thus guaranteeing success.